<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1463985935940&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2F10-retirement-statistics-will-scare-crap.html%2F%3Fa%3Dviewall&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2F10-retirement-statistics-will-scare-crap.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.14374830257748072"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1463985935940&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2F10-retirement-statistics-will-scare-crap.html%2F%3Fa%3Dviewall&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2F10-retirement-statistics-will-scare-crap.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.14374830257748072"

border="0" alt=""></a>

Scary retirement statistics | Source: Dimension Films

America’s

retirement crisis

is the most gruesome wreck you’ll find on Main Street. New victims are

discovered every day amid a financial bloodbath of too much debt, not

enough savings, and stalled wages. We can’t look away — nor should we.

More than ever, you need to take an active role in preparing your

future self for a time when you’ll want or need to retire. The

company-pension airbag is officially deflated. In 1974, the original IRA

was

introduced

after Congress passed the Employee Retirement Income Security Act. Four

years later, the IRS added a little paragraph to the tax code that led

to the first 401(k) being created in 1981. Today, IRA and 401(K)

retirement accounts have replaced pensions, with one glaring downside:

They are do-it-yourself retirement plans.

When faced with a choice on a seemingly complex subject such as

saving for retirement, individuals often take the default or “no

decision” choice. In the case of voluntary retirement plans, which

require participants to take action in order to save money, the “no

decision” choice is a decision not to save. This is slowly changing as

more employers are

automatically enrolling

workers into 401(k) plans, but if you need a good scare to get you

interested in your own retirement, we’ve assembled a list of the

scariest retirement statistics.

Let’s take a look at 10 retirement statistics that will scare the

crap out of you, and hopefully get you thinking about saving more for

your future self.

1. Nothing saved for retirement

Your mama may have told you to be happy with what you’ve got, but

that isn’t much if we’re talking about retirement savings. A recent

survey from

GoBankingRates.com

finds more than half of Americans have less than $10,000 saved for

retirement, with one in three having nothing saved. The National

Institute on Retirement Security

estimates the nation’s retirement savings gap is between $6.8 and $14 trillion.

Exactly how much you need to save for retirement is an ongoing debate, but one thing is clear: You’ll need more than nothing.

2. Healthcare costs are sickening in retirement

Health truly equals wealth in retirement. Research from

Fidelity

says a couple that retired in 2015, both aged 65, can expect to spend

an estimated $245,000 on healthcare throughout retirement. That’s up

from $220,000 in 2014 and $190,000 in 2005. Longer life expectancies and

anticipated annual increases for medical and prescription expenses are

the primary factors raising the bill.

“The sticker shock of $245,000 hopefully reinforces for many people

that they need to act now, regardless of their age,” said Brad Kimler,

executive vice president of Fidelity’s Benefits Consulting Services, in a

press release. “For people offered a high-deductible health plan with a

health savings account at work, choosing this option can really help

them prepare, especially for Millennials who have a long time to save.”

3. You might be in it for the retirement long haul

Once you hit age 65, roughly the average retirement age, your odds of

living for another decade or two is quite high. Men age 65 today have a

78% chance of living another 10 years, while women have an 85% chance,

according to

research

from JPMorgan. The odds of a long life increase dramatically for

couples. In fact, couples age 65 today have an astounding 97% chance

that at least one of them lives another 10 years and an 89% chance that

one experiences their 80-year birthday. It almost comes down to a coin

flip that at least one person in the relationship lives to 90.

In short, you should plan on living to at least 90 or perhaps even

longer, depending on your family history. I once had an Ameriprise

financial planner tell me he usually assumes his clients are going to

live to be 100, just to be on the safe side.

4. Student loans could come back to haunt your golden years

Millennials know all too well the financial burden of college debt. Recent

findings

from the LIMRA Secure Retirement Institute reveal that millennials who

start their careers with $30,000 in student loans could find have

$325,000 less in retirement savings compared to debt-free peers. This is

a fairly typical debt load for student debt. In 2015, the average

student loan debt totaled $33,000, compared to $10,000 in 1990.

Debt isn’t always terrible. In fact, debt is merely borrowing from

your future self. It can be a wise investment if it leads to a

significant increase in your earning potential. The trick is researching

career options ahead of time and realizing there are ways to reduce how

much you spend on a college degree. Financial aid, scholarships,

technical degrees, and community colleges may all help dampen the impact

of education costs. At least six different

student loan forgiveness programs exist to help you erase college debt.

5. Financial literacy took a detour

I’m reminded of a quote from Mickey Mantle: “It’s unbelievable how

much you don’t know about the game you’ve been playing all your life.”

It’s unbelievable how much people don’t know about an object they’ve

been trying to acquire all their life. Standard & Poor’s conducted

interviews with over 150,000 adults in more than 140 countries to gauge

global

financial literacy.

The results are painful. Only 33% of adults worldwide are able to

correctly answer at least three out of four financial concepts involving

risk diversification, inflation, numeracy, and compound interest. That

means around 3.5 billion adults globally, most of them in developing

economies, lack an understanding of basic financial concepts.

A lack of understanding creates an abundance of uncertainty and stress, which helps explain why 60% of employees

report

feeling somewhat or very stressed about their financial situations, or

why 62% of millennials want a financial advisor to walk them through

every step of the retirement planning process.

6. Millions miss out on “free” retirement money

We need all the help we can get when it comes to saving for

retirement. Unfortunately, millions of Americans aren’t doing themselves

any favors. According to Financial Engines, an independent investment

advisor, one quarter of employees are not saving enough money to receive

their employer’s

401(k) match.

On average, those employees are missing out on an extra $1,336 a year,

or a little less than an extra $25 a week. Overall, Americans are losing

an estimated $24 billion every year in matching contributions.

Wait, it gets worse. Retirement savers are also leaving money on the table with the

Saver’s Credit.

Only 25% of American workers with annual household incomes of less than

$50,000 are aware of the tax credit, which is a benefit available to

low- and moderate-income workers saving for retirement. The credit

reduces a taxpayer’s federal income tax and may be applied to the first

$2,000 ($4,000 if married and filing jointly) of voluntary contributions

an eligible worker makes to a 401(k), 403(b), or similar

employer-sponsored retirement plan, or an individual retirement account

(IRA).

It’s not always easy to contribute to your retirement accounts, and

there’s always an excuse to not do something, but nobody cares about

your future self like you. If you’re having trouble deciding how to

tackle your savings strategy, check out our

Savings 101: Your Cheat Sheet to Financial Security.

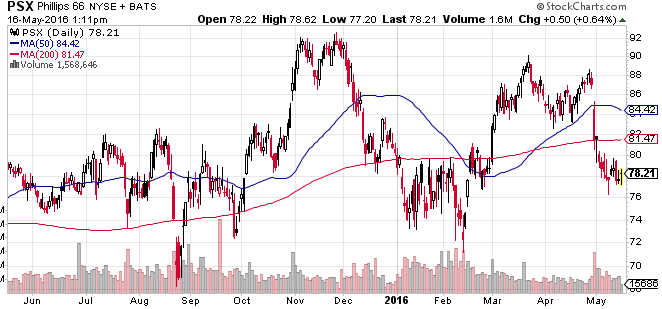

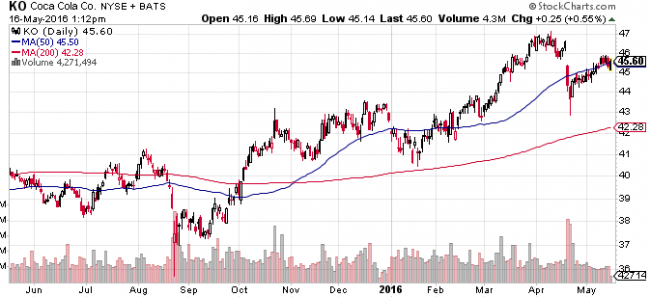

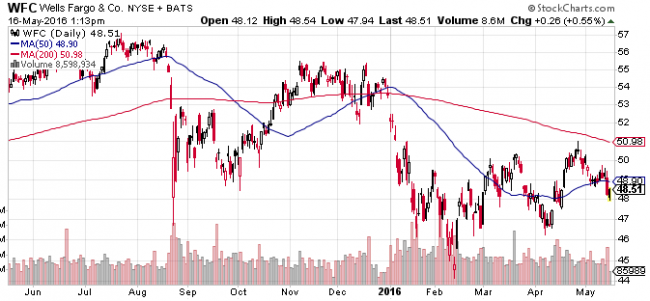

7. The market can be a slug sometimes

The stock market has three directions: up, down, and sideways. If

investing in stocks is part of your retirement plan, building wealth can

feel like slow process when the market isn’t moving up in a nice,

straight line. Your retirement balances may even move backwards from

time to time.

Fidelity’s

analysis

of retirement accounts reveal that average balances dipped in the

beginning of 2016. The average 401(k) balance fell from $91,800 in the

first quarter of 2015 to $87,300 in the first quarter of 2016. The

average IRA balance fell from $94,100 to $89,300 over the same period.

These declines are due to the stock market’s worst new-year start in

history, which is why it’s vital that you think of investing as a

multi-decade process, and not get caught up in short-term volatility.

8. Fees can rob your retirement blind

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1463985936546&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2F10-retirement-statistics-will-scare-crap.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2F10-retirement-statistics-will-scare-crap.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.19788078805479004"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1463985936546&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2F10-retirement-statistics-will-scare-crap.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2F10-retirement-statistics-will-scare-crap.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.19788078805479004"

border="0" alt=""></a>

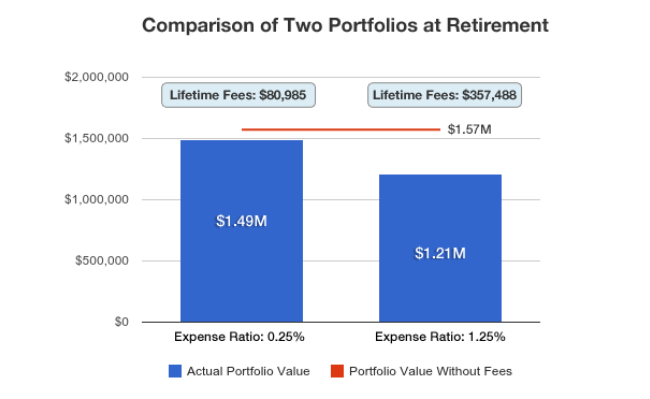

Retirement fees | Source: FutureAdvisor

Life is full of fees: convenience fees, installation fees,

cancellation fees, ATM fees, checked-bag fees, it never ends. Most of

the time these fees are expressed in dollar signs, unless we’re talking

about investing fees. Wall Street has some of the most elusive fee

disclosures you’ll find. Instead of dollar signs, expense ratios (the

most common fees in retirement accounts) are expressed as percentages.

For example, an expense ratio of 1.25% sounds insignificant but in terms

of dollars, that fee will cost you $125 annually for every $10,000

invested. Compounded over time, that adds up to staggering amounts.

Making matters worse, you don’t see the fee subtracted from your balance

statement. Instead, it’s subtracted from your market returns before

your statement is even made.

FutureAdvisor

calculates how different expense ratios affect two identical 401(k)

portfolios starting at $10,000, and receiving the maximum annual

contribution for 40 years. The first portfolio has an expense ratio of

only 0.25%. It reaches a value of $1.49 million, with $80,985 in

lifetime fees paid. The second portfolio has an expense ratio of 1.25%.

It reaches a value of $1.21 million. That’s still a nice payday, but

lifetime fees totaled a whopping $357,488. You could have saved $276,503

by simply choosing a low-cost fund (all other things equal).

Lesson learned: Pay attention to fees. You don’t always get what you

pay for on Wall Street. If you notice an abundance of high-cost funds in

your 401(k), talk to your employer about switching providers. Some

employers actually do care about their employees’ retirement options.

Examples of low-cost providers include Ubiquity, Employer Fiduciary, and

Vanguard.

9. You might not retire on your own terms

Not everyone will be able to work well into their 80s like Warren

Buffett, or well into their 90s like his right-hand man Charlie Munger.

Gallup finds the average retirement age is 62. This corresponds with the

Center for Retirement Research at Boston’s

research that finds the average retirement age is about 64 for men and 62 for women.

Retiring when you’re physically and financially able to enjoy life is

great news, but that’s not always the case. In fact, 55% of retirees

actually

retired earlier than expected,

with health reasons cited as the number one reason, followed by job

loss. The third of workers expecting to never retire are in for a rude

awakening. Don’t count on being able to work longer to make up for a

lack of savings.

10. Social Security to become less sociable

Nobody knows what exactly Social Security will look like in a couple

decades, but it will most likely be different in some capacity. Without

some type of reform, benefits will need to be cut by 23% in aggregate in

2033, according to a

recent report

from the Social Security Administration. In other words, after the

depletion of reserves, continuing tax income is expected to be

sufficient enough to pay 77% of scheduled benefits in 2033.

Social Security is a lifeline to retirees. According to the

Transamerica Center for Retirement Studies, Social Security is the most

common cited source of income for retirees, with savings and investments

at a distant second. The median age they started collecting benefits

was 62. In fact, the Economic Policy Institute, a nonpartisan think

tank, estimates that Social Security keeps nearly 27 million Americans

above the

poverty threshold, as gauged by the Supplemental Poverty Measure.

Culled from Money & Career Cheat Sheet