Retirement statistics | iStock.com

It’s time for Americans to face the reality of

retirement planning,

especially younger Americans. Considering that defined benefit plans

are moving closer to full extinction each year, it’s now more important

than ever for individuals to save for retirement. This is not always an

easy process, but you can improve your odds of an ideal retirement by

educating yourself and planning for it as soon as possible.

Millions of Americans are worried about their so-called

golden years — with good reason. According to Bankrate.com, 28% of Americans say high medical bills are their

top financial concern about retirement.

Making matters worse, higher income provides little comfort. Households

making more than $75,000 are actually more worried about medical

expenses than the overall population. Meanwhile, 23% of Americans say

running out of savings is their biggest financial concern, followed by

18% who say unaffordable daily expenses. Eleven percent of Americans are

most worried about having too much debt in retirement.

With stagnant wages, rising living expenses, and an overall sluggish

labor market, numerous obstacles face workers trying to save for

retirement, but no one cares about your financial future as much as you.

Let’s take a look at 10 charts that are crucial to the retirement

planning process.

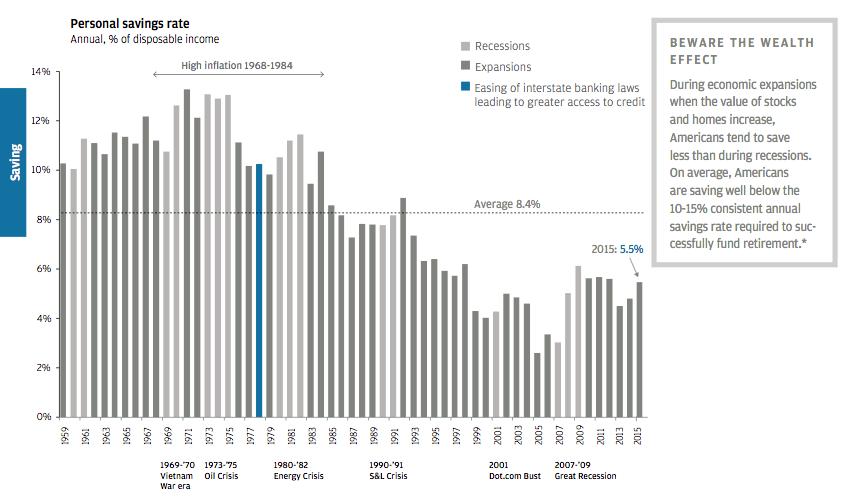

1. Savings rate

Personal savings | J.P. Morgan

Americans are not known for their prudent saving habits. If anything,

we’re renowned for being the largest consumer market in the world. We

work hard to buy things we don’t really need. When we can’t afford

something, we simply use debt to achieve instant gratification,

prolonging the cycle of poor savings.

As the chart above shows, the national savings rate has mostly

declined for about the past 40 years. In 2014, the rate reached a dismal

4.8%, compared to a long-term average of 8.4%. The rate rebounded in a

slightly less dismal 5.5% in 2015. J.P. Morgan finds that an alarming

number of people are not even interested in saving. In 2015, only 48%

had tried to calculate how much money they would actually need to save

for retirement.

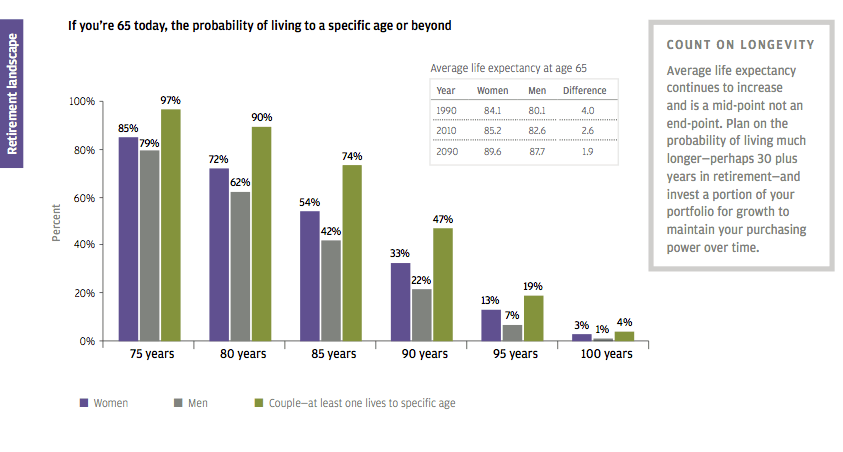

2. Life expectancy

Life expectancy | J.P. Morgan

As you near the typical retirement age, the probability of you living

for another decade or two is remarkably high. Men age 65 today have a

79% chance of living another 10 years, while women have an 85% chance.

The odds of a long life increase dramatically for couples.

In fact, couples age 65 today have an astounding 97% chance that at

least one of them lives another 10 years and an 90% chance that one

experiences their 80-year birthday. It almost comes down to a coin flip

that at least one person in the relationship lives to 90.

In short, you should plan on living to at least 90 years old or

perhaps even longer, depending on your family history. While more people

are working beyond the age of 65, that doesn’t mean you should assume

you will be able to do so. J.P. Morgan finds that 67% of employed

Americans plan to work beyond age 65, but only 23% of actual retirees

did, citing health problems and employer issues.

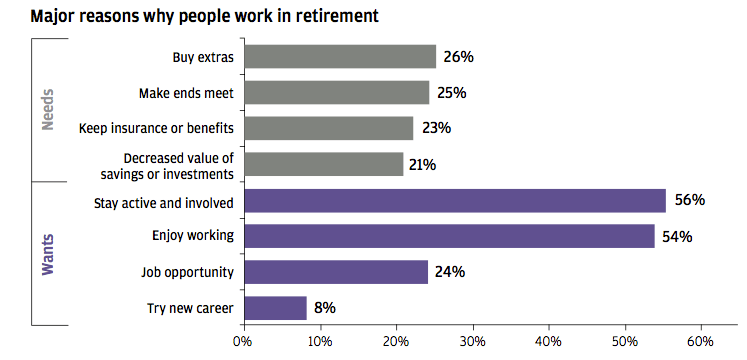

3. Health care

Retirement work | J.P. Morgan

Living longer has a hefty price. More Americans are expected to stay

in the workforce in order to compensate for increased lifespans and

expenses. Using data from the Bureau of Labor Statistics, JP Morgan

estimates that 23% of the civilian labor force in 2024 will be made up

of people in their early 70s, nearly double the amount in 1994. Fourteen

percent of workers are expected to be 75 to 79 years old, compared to

only 7% in 1994. As the chart above shows, 25% of working retirees stay

on the clock to make ends meet, while 23% do so to keep insurance or

benefits.

How much might you spend on health care in retirement? A Fidelity

analysis

estimates a 65-year-old couple retiring in 2016 will need $260,000 to

cover health care costs in retirement, excluding long-term care

insurance. That’s up 6% from the $245,000 estimated for a couple

retiring in 2015. The estimate applies to retirees with traditional

Medicare insurance coverage and provides a general idea of the monthly

expenses associated with Medicare premiums, Medicare co-payments and

deductibles, and prescription drug out-of-pocket expenses.

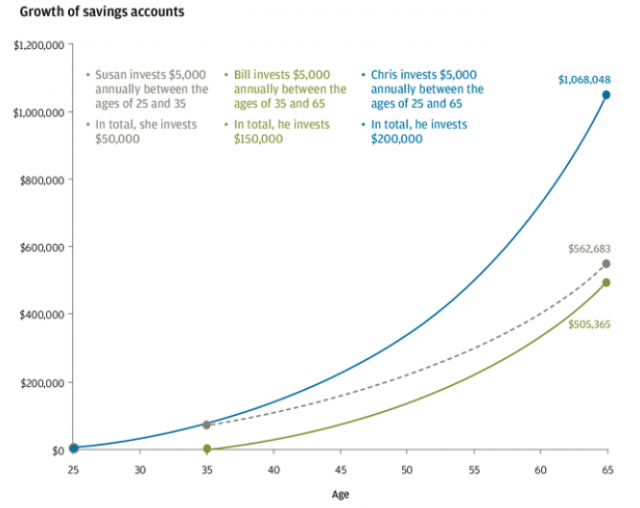

4. Saving early

Save early for retirement | J.P. Morgan

We’ve all heard it before: You need to start saving for retirement as

soon as possible. It’s a simple concept, but many people fail to

understand the long-term effects of saving and investing early. As the

chart above shows, a person who invests $5,000 annually between the ages

of 25 and 35 will have an estimated $563,000 at age 65, assuming a 7%

annual return. In comparison, a person who invests $5,000 between the

ages of 35 and 65 will have about $58,000 less.

Market returns are not guaranteed and are certainly more volatile

than 7% each year, but the math shows the benefits of compounding

returns. The earlier you start, the better your chances of reaching your

financial goals. Your chances also improve if you start early and keep a

consistent pace. A person who invests $5,000 annually between the ages

of 25 and 65 could accumulate more than $1 million for retirement.

5. Spending habits

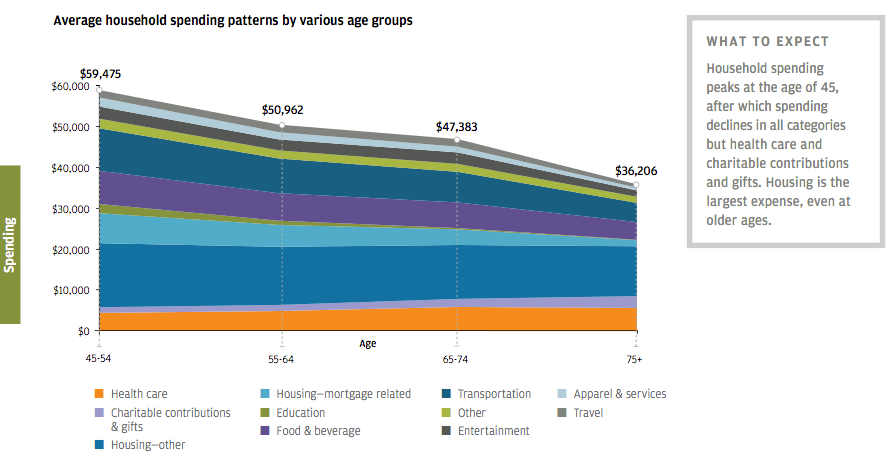

Retirement spending habits | J.P. Morgan

Predicting your exact income needs for retirement decades in advance

is impossible. Nonetheless, you should recognize that you may have more

expenses than you think. On average, American household spending peaks

at age of 45. However, as the chart above shows, there are still

significant costs after the peak and during retirement.

The average spending for 65- to 74-year-olds totals $47,383 per year —

not exactly chump change. If you’re 35 today, imagine how much you’ll

be spending in 30 years due to inflation. If you plan on traveling in

retirement, your costs could be even higher. Additionally,

healthcare is the one category of spending

that fails to log a decrease. If you invest in nothing else for

retirement, at least invest in your health. Eliminating mortgage debt

and making sure your house fits your actual needs is also helpful in

reducing retirement expenses, as housing-related costs represented the

largest portion of spending among all age groups.

6. Nursing home expenses

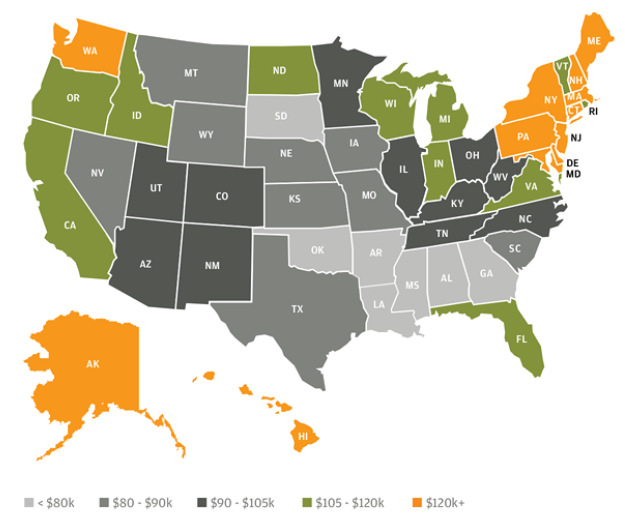

Nursing home expenses | J.P. Morgan

One of the most overlooked retirement costs (it’ll-never-happen-to-me

syndrome) may also be one of the most expensive. J.P. Morgan finds that

the cost of a private room nursing care facility for one year can vary

from $80,000 to over $120,000, depending on where you live. However, a

majority of Americans underestimate the costs of nursing home care and

are neglecting the need to save for it.

Nearly 57% of Americans believe a year in a

nursing home will cost

them less than $75,000, according to a recent survey by MoneyRates.com.

A study by MetLife finds that even semi-private rooms cost an average

of $81,030 per year. Furthermore, the average cost of a semi-private

room in the New York City area is $141,620, which is 75% higher than the

national average. In contrast, Louisiana, Alabama, Oklahoma, and

Missouri offer some of the cheapest long-term care services in the

country.

7. Social Security

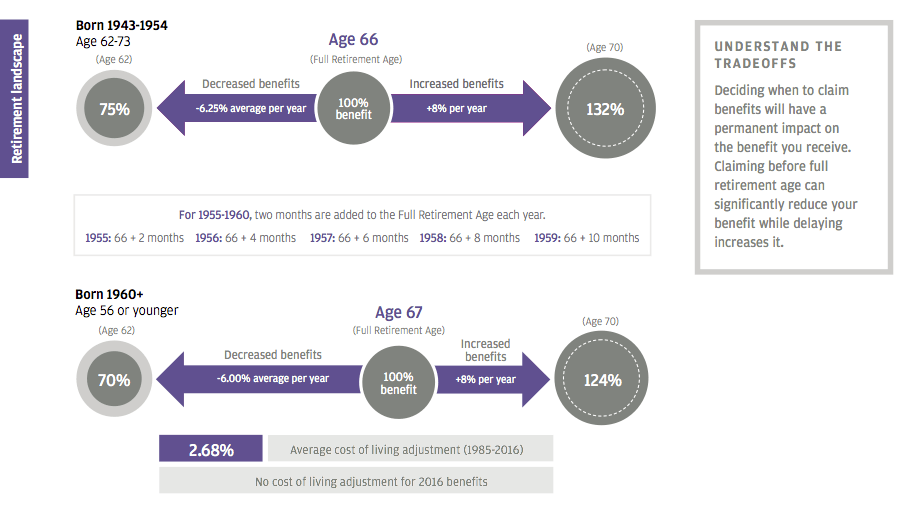

Social Security | J.P. Morgan

If you can, delaying Social Security benefits may help you achieve a

more secure retirement. The top graphic illustrates how people born 1943

to 1954 can receive 32% more in a benefit check by waiting until age 70

to claim Social Security, compared to the full retirement age of 66. At

age 62, beneficiaries receive only 75% of what they would get if they

waited until age 66. The bottom graphic shows the trade-offs for younger

individuals, which penalizes early claiming by offering 70% of benefits

at age 62. Delaying benefits until age 70 results in 24% more benefits

than full retirement age 67.

If you have a health problem or family history indicating you will

not live for decades beyond age 62, you may want to claim Social

Security as soon as possible so that you have time to enjoy the fruits

of your labor. On the other hand, if your health and finances are

stable, you may want to wait. The Social Security Administration now

offers online accounts so that Americans can

stay up to date on their financial situations.

8. Investing

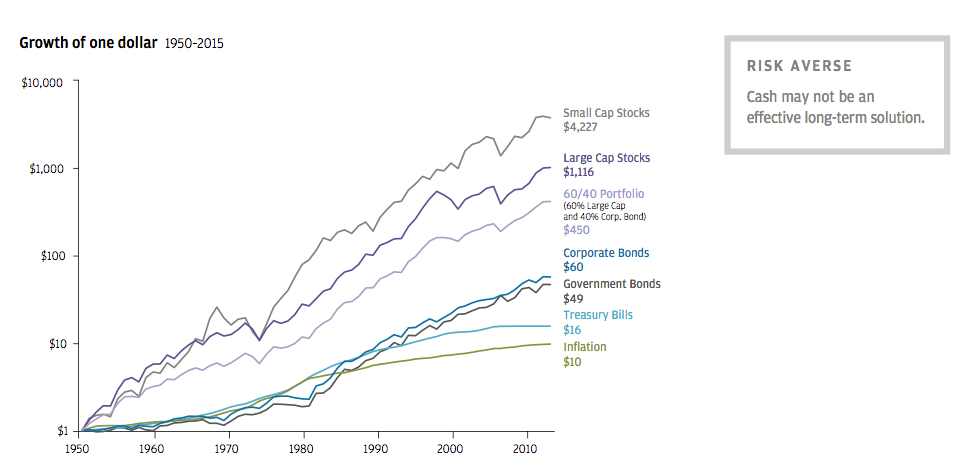

Investment growth | J.P. Morgan

Due to inflation eroding the value of money, it’s not enough to

simply let your savings sit in cash. One dollar invested in Treasury

bills in 1950 would have only grown to $16 in 2015. However, that same

dollar invested in large-cap stocks would have grown to $1,116, while

small-cap stocks would have grown that dollar into $4,227. There are

certainly other investment choices than stocks, but this illustration

reminds investors that cash is a terrible wealth generator over the long

term.

Warren Buffett once explained how investors

should view cash. He said:

“The one thing I will tell you is the worst investment

you can have is cash. Everybody is talking about cash being king and all

that sort of thing. Cash is going to become worth less over time. But

good businesses are going to become worth more over time. And you don’t

want to pay too much for them so you have to have some discipline about

what you pay. But the thing to do is find a good business and stick with

it. We always keep enough cash around so I feel very comfortable and

don’t worry about sleeping at night. But it’s not because I like cash as

an investment. Cash is a bad investment over time. But you always want

to have enough so that nobody else can determine your future

essentially.”

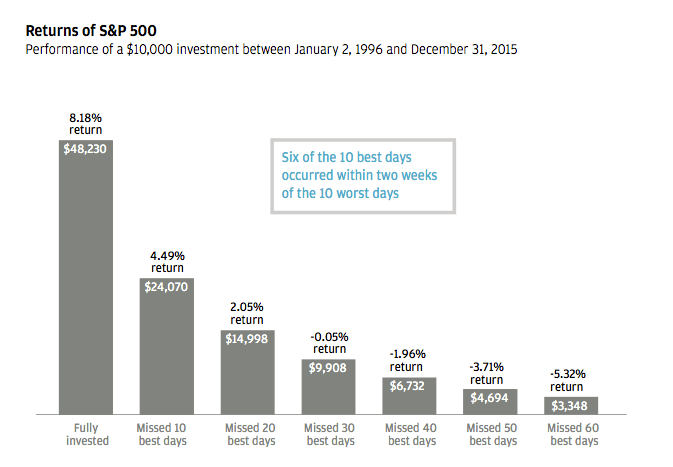

9. Market timing

Market timing | J.P. Morgan

Unless you’re a day trader, you should not be trying to time the

market. With the rise of smartphones and tablets, investors are

constantly plugged into financial markets, but that doesn’t mean you

should always be doing something with your portfolio. The average Joe is

typically better off with a diversified portfolio built for the long

term. Trying to time the market can be disastrous, especially when it

comes to stocks and your retirement.

As the chart above shows, $10,000 invested between January 2, 1996,

and December 31, 2015, would have grown to $48,230 if it was constantly

invested in the S&P 500. If you missed the 10 best days during that

period, the investment would have grown to only $24,070, just less than

half of the amount if you simply left the money untouched. Critics

rightly point out that missing the worst days in the market is even

better for a portfolio, but that is a dangerous strategy for most

investors.

Even if you rightly time the market and avoid the worst days, you are

then left with the agonizing decision of when to get back into the

market. You need to know yourself and your limitations when investing.

Six of the 10 best days during the stated time period occurred within

two weeks of the 10 worst days. The market is like a seesaw in the

short-term, but becomes more stable through diversification and time.

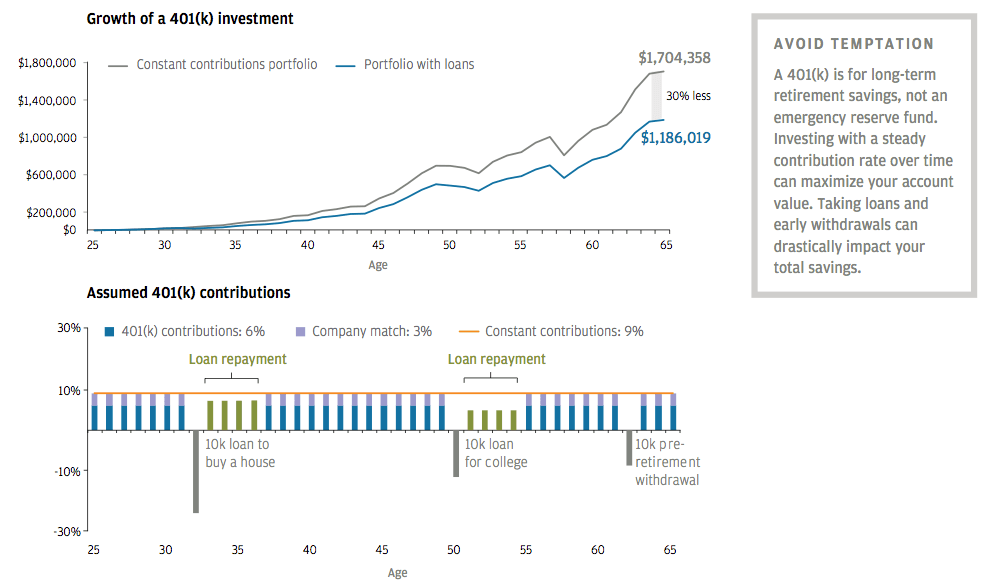

10. Early withdrawals from retirement accounts

401(k) early withdrawals | J.P. Morgan

Life happens. You may have a personal financial crisis hit you so

hard that the only place to lick your wounds is your retirement account.

However, if at all possible, you should probably avoid pulling money

from your retirement account before you do indeed retire. The chart

above shows how costly it can be to take money from a 401(k). Three

$10,000 loans throughout your working career could potentially cost you

more than half a million dollars, or 30% of your portfolio! That’s based

on several assumptions, like a 60/40 portfolio, but the lesson is the

same. Your money and financial future stands to benefit from compounding

returns if it’s invested constantly, and not being pulled out ahead of

schedule. Regularly contributing to a retirement plan as early as

possible can also amount to significant nest eggs.

Culled from Money & Career Cheat Sheet

![Executive Secretary, Pension Transitional Arrangement Directorate, PTAD, Barr. Sharon Ikeazor [Photo: icpc.gov.ng]](https://i0.wp.com/media.premiumtimesng.com/wp-content/files/2017/03/Sharon-Ikeazor.jpg?fit=860%2C572)