<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1463466467102&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.555851769413456"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1463466467102&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.555851769413456"

border="0" alt=""></a>

Warren Buffett | Drew Angerer/Getty Images

Warren Buffett

is no stranger to multibillion-dollar investments. The Oracle of Omaha

has been beating the market for decades while accumulating positions in

some of the world’s most popular companies. Courtesy of a

new filing, we now have a peek at how the legendary investor deployed capital in the first three months of 2016.

Many institutional investment managers recently filed their mandatory

13F with the Securities & Exchange Commission (SEC). The filing is a

quarterly report of equity holdings required by managers who oversee

more than $100 million in qualifying assets and must be filed within 45

days of the end of each quarter. The 13F provides a glance at what firms

did in the previous quarter, but investors should keep in mind that

hedging and trading strategies of each fund are still unknown.

Buffett’s Berkshire Hathaway made several changes in the three months

ended March 31, 2016. The conglomerate reduced its stakes in

Mastercard, Wal-Mart, and Procter & Gamble. In fact, its Procter

& Gamble position was slashed from 52.8 million shares (worth $4.2

billion) at the end of 2015 to only 315,400 shares (worth $26 million)

at the end of the first quarter, reflecting the Duracell swap announced

in 2014. Berkshire Hathaway also sold off its $1.6 billion position in

AT&T, but added a new $1.1 billion position in Apple, and increased

its stakes in Bank of New York Mellon, Deere, Visa, and International

Business Machines. The

new Apple position was not purchased directly by Buffett.

The largest investments in Berkshire Hathaway’s portfolio include

some of the most popular blue chips known to Wall Street. Let’s take a

look at Berkshire Hathaway’s top seven holdings according to dollar

value at the end of March, not including Buffett’s option to purchase

700 million shares of Bank of America at any time prior to September

2021 for $5 billion.

7. Wal-Mart

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1463466467521&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.8718103041320929"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1463466467521&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.8718103041320929"

border="0" alt=""></a>

WMT stock price | Source: Stockcharts.com

The famous discount retailer is Berkshire Hathaway’s seventh largest

holding. While shares have trended higher in 2016, Berkshire Hathaway

cut its position by almost 1 million shares. Buffett and company owned

55.2 million shares (worth $3.8 billion) at the end of the first

quarter.

6. Phillips 66

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1463466467522&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.9665541142791588"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1463466467522&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.9665541142791588"

border="0" alt=""></a>

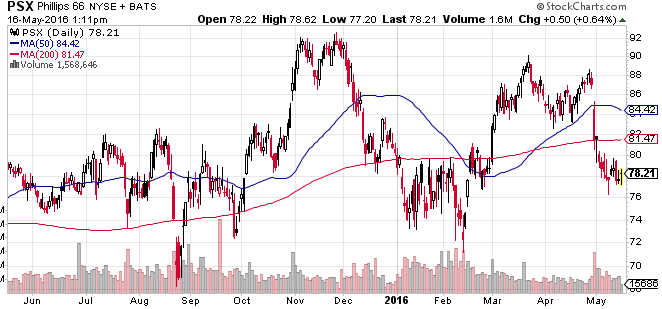

PSX stock price | Source: Stockcharts.com

The multinational American energy company was originally thought to

be sold off by Buffett in the second quarter of 2015. As it turns out,

Buffett had the stake classified as confidential so it wouldn’t show on

the 13F and allow copycat investors to run the price up. At the end of

March, Berkshire Hathaway held 75.6 million shares (worth $6.5 billion)

of Phillips 66, up from 61.5 million shares in the previous quarter,

according to the 13F.

Unlike oil giants Exxon Mobil and Chevron, Phillips 66 has escaped most of the carnage seen in the energy sector.

Buffett told CNBC

in September: “We’re buying it because we like the company and we like

the management very much.” Berkshire Hathaway also has a relatively

small position in Kinder Morgan, the largest energy infrastructure

company in North America.

5. American Express

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1463466467410&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.206300618926337"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1463466467410&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.206300618926337"

border="0" alt=""></a>

AXP stock price | Source: Stockcharts.com

Financial services is a popular sector for Buffett. Berkshire

Hathaway held 151.6 million shares of American Express at the end of

March, unchanged from the prior quarter and worth $9.3 billion. Shares

have stumbled over the past year.

Costco recently severed ties from American Express after 16 years in

business with each other. American Express was able to make a deal with

Sam’s Club, the other warehouse giant fighting for consumers, but it has

done little to comfort Mr. Market. Berkshire Hathaway’s positions in

Mastercard and Visa come no where close to the size of its American

Express position.

4. IBM

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1463466467625&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.056997629428132024"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1463466467625&url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.width=642&c.height=95&c.tag_id=21781&c.taglink_id=33490&c.scale=1.1339564&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fpersonal-finance%2Fwarren-buffetts-top-7-favorite-stocks.html%2F%3Fa%3Dviewall&c.params=&c.impression_type=26&c.placement_id=ad0.056997629428132024"

border="0" alt=""></a>

IBM stock price | Source: Stockcharts.com

If you’re looking for a reason not to follow in Buffett’s footsteps,

IBM is it. The company was the worst performer in the Dow Jones

Industrial Average in 2014, and one of the worst performers in 2015. In

fact, shares have lost about 25% since hitting all-time highs above $200

in 2013, and revenue has fallen for 16 consecutive quarters. However,

Buffett isn’t giving up. During the first quarter, Buffett increased his

position slightly to 81.2 million shares, worth $12.3 billion. IBM is

up about 8% this year, and has a dividend yield of 3.7%.

3. Coca-Cola

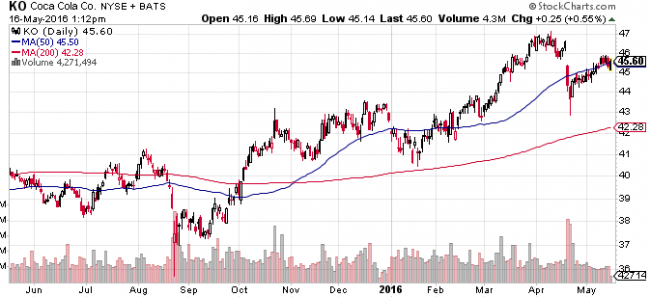

KO stock price | Source: Stockcharts.com

Coca-Cola is the most predictable position at Berkshire Hathaway.

Buffett is on record saying he will never sell his shares in the

world-renowned beverage company, and can often be seen holding a Cherry

Coke. At the end of the first quarter, Berkshire Hathaway held the usual

400 million shares of Coca-Cola, worth $18.6 billion. That’s up from a

value of $17.2 billion at the end of 2015. Shares have been regaining

ground this year as investors seek stability and yield. Shares of

Coca-Cola have a 3% dividend.

Coca-Cola has investments in Monster Beverage, Keurig Green Mountain,

and Suja Juice. The company is also making operating changes to drive

stronger growth and save $3 billion annually by 2019.

2. Wells Fargo

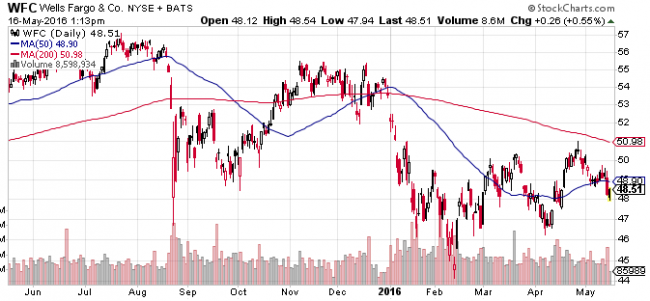

WFC stock price | Source: Stockcharts.com

America’s most profitable bank is Buffett’s second biggest holding.

Berkshire Hathaway held 479.7 million shares (worth $23.2 billion) of

Wells Fargo at the end of the first quarter, unchanged from the previous

quarter. Shares of Wells Fargo are in the red this year, but they pay a

respectable dividend of 3.1%. In the most recent quarter, Wells Fargo

announced net income of $5.5 billion, down from $5.8 billion a year

earlier.

1. Kraft Heinz

KHC stock price | Source: Stockcharts.com

Berkshire Hathaway’s position in the recently merged Kraft Heinz has

been listed on the 13F for the past three quarters. Buffett teamed up

with investment firm 3G Capital to takeover Kraft Foods with Heinz. The

deal created one of the biggest food companies in history, with over 10

different brands valued at more than $500 million each. More recently,

the company has

laid of thousands of workers to cut costs and “consolidate manufacturing across the Kraft Heinz North American network.”

Buffett and company held 325.6 million shares of Kraft Heinz at the

end of March, worth a whopping $25.6 billion. That makes Kraft Heinz

Buffett’s largest portfolio holding.

Culled from Money & Career Cheat Sheet

No comments:

Post a Comment