Warren Buffett | Drew Angerer/Getty Images

Many institutional investment managers recently filed their mandatory 13F with the Securities & Exchange Commission (SEC). The filing is a quarterly report of equity holdings required by managers who oversee more than $100 million in qualifying assets and must be filed within 45 days of the end of each quarter. The 13F provides a glance at what firms did in the previous quarter, but investors should keep in mind that hedging and trading strategies of each fund are still unknown.

Buffett’s Berkshire Hathaway made several big changes in the three months ended December 31, 2016. In fact, this was one of the most exciting 13F releases from Buffett and company in recent history. Buffett also recently disclosed that Berkshire Hathaway purchased a net $12 billion in stock since the presidential election.

The conglomerate sold off its stakes in Deere and Kinder Morgan, two positions that had already been reduced in a prior 13F release. Berkshire Hathaway decreased its stakes in Verizon and Wal-Mart, but opened new positions in Monsanto, Siri XM, and Southwest Airlines.

The largest investments in Berkshire Hathaway’s portfolio include some of the most popular blue chips known to Wall Street. Let’s take a look at Berkshire Hathaway’s top nine holdings according to dollar value at the end of December, not including Buffett’s option to purchase 700 million shares of Bank of America at any time prior to September 2021 for $5 billion. No. 7 is new to our Cheat Sheet list of Buffett’s biggest holdings, but it’s one of the most loved companies in the world.

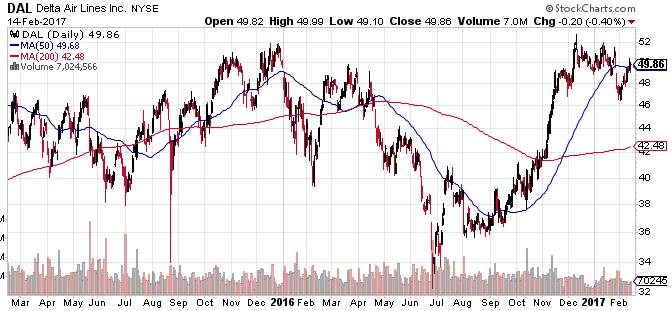

9. Delta Air Lines

DAL stock price | StockCharts.com

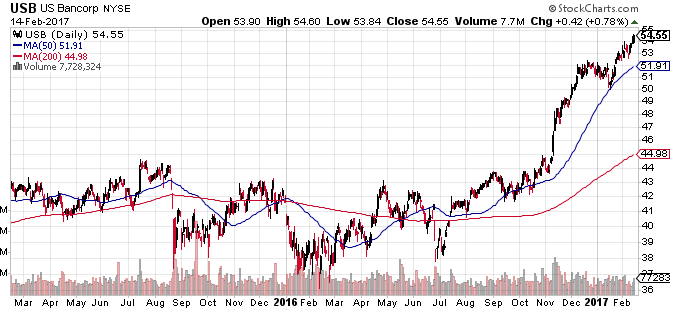

8. U.S. Bancorp

USB stock price | StockCharts.com

U.S. Bancorp is based in Minneapolis and has nearly half a trillion dollars in assets. It’s the parent company of U.S. Bank National Association, the fifth largest commercial bank in the United States. The Company operates 3,106 banking offices in 25 states and 4,842 ATMs. In October, MONEY named U.S. Bank the Best Big Bank in a tie with TD Bank.

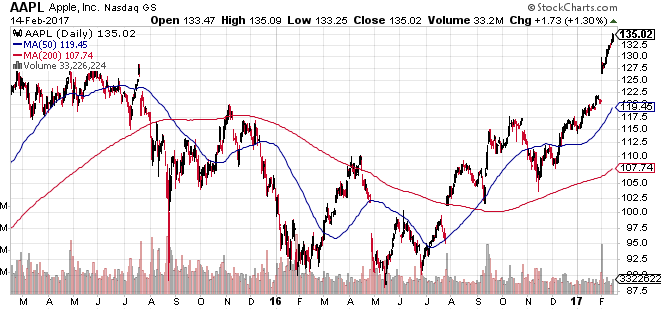

7. Apple

AAPL stock price | StockCharts.com

Despite concerns about growth, Apple doesn’t appear to be slowing down. The company sold 78 million iPhones in the holiday quarter, setting a new record. Apple also set new revenue records for the iPhone, Services, Mac, and Apple Watch. Furthermore, Apple’s cash hoard of $246 billion will likely continue to reward investors with dividends and share buybacks for years to come. Apple returned $15 billion to investors in the fourth quarter alone.

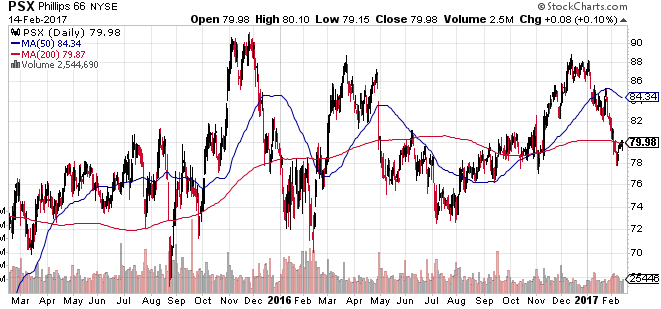

6. Phillips 66

PSX stock price | StockCharts.com

Unlike oil giants Exxon Mobil and Chevron, Phillips 66 has escaped most of the carnage seen in the energy sector. Buffett told CNBC in 2015: “We’re buying it because we like the company and we like the management very much.”

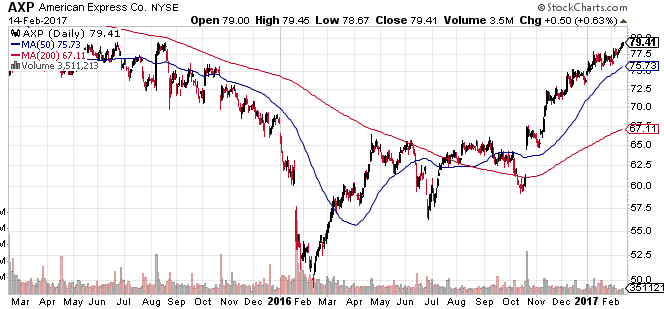

5. American Express

AXP stock price | StockCharts.com

American Express shares have struggled in recent years. Costco severed ties from American Express after 16 years in business with each other. American Express was able to make a deal with Sam’s Club, but it did little to comfort Mr. Market at the time. However, shares found a bottom in early 2016 after touching $50, and are in the green this year. Berkshire Hathaway’s positions in Mastercard and Visa come nowhere close to the size of its American Express position.

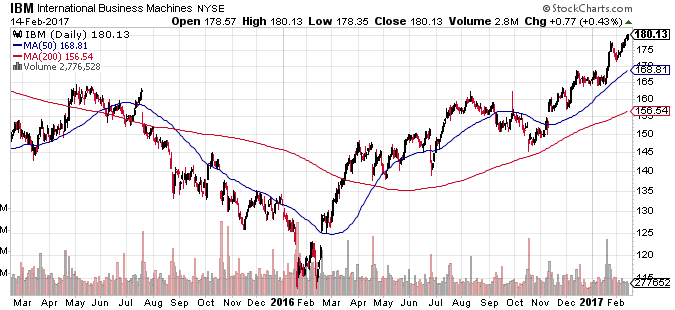

4. International Business Machines

IBM stock price | StockCharts.com

IBM is Berkshire Hathaway’s No. 4 largest holding. At the end of the fourth quarter, the company held 81.2 million shares (worth $13.5 billion). IBM shares still offer a dividend north of 3%.

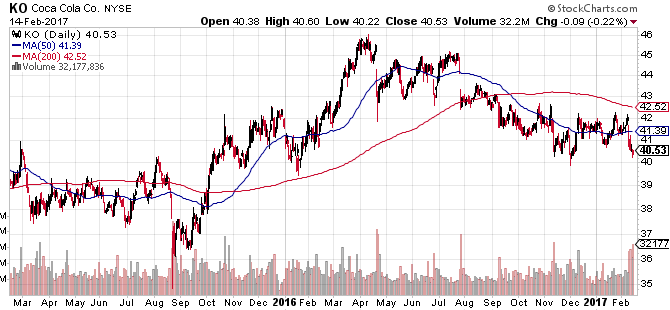

3. Coca-Cola

KO stock price | StockCharts.com

While sugar water has seen its fair share of problems in recent years, Coca-Cola shares have been experiencing support near $40 since late 2015. Coca-Cola has investments in Monster Beverage, Keurig Green Mountain, and Suja Juice. The company is also making operating changes to drive stronger growth and save $3 billion annually by 2019.

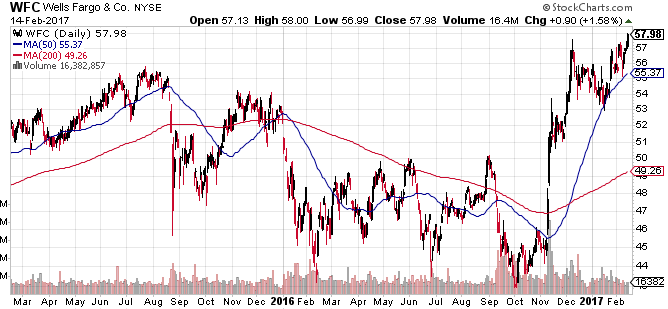

2. Wells Fargo

WFC stock price | StockCharts.com

Wells Fargo quickly become Buffett’s most controversial holding in September. The mega bank finally admitted it created roughly 2 million fake accounts, which inflated sales numbers and banking fees. Wells Fargo had an incentive program in place that essentially forced employees to commit fraud or risk being fired for underperforming unrealistic sales goals. More than 5,000 workers related to the scandal were fired. Wells Fargo CEO John Stumpf also resigned in the wake of the financial abuse. Buffett appears to be standing by Wells Fargo for now.

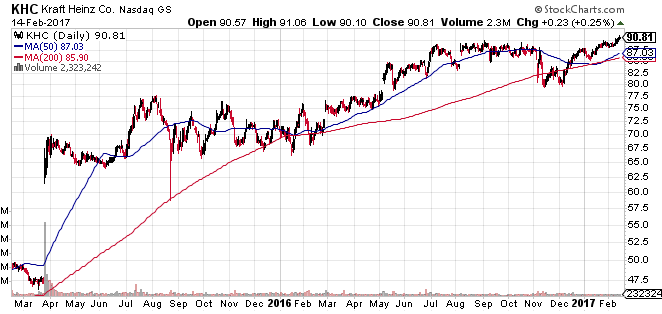

1. Kraft Heinz

KHC stock price | StockCharts.com

Buffett and company held 325.6 million shares of Kraft Heinz at the end of December, worth a whopping $28.4 billion. That makes it Buffett’s largest portfolio holding.

Disclosure: Author holds BRKB and AAPL

No comments:

Post a Comment