It’s official. Money-savvy millennials are better at

managing their finances

than their parents and grandparents. When compared to baby boomers,

people between the ages of 18 and 33 were more likely to track expenses

and stick to a budget, a 2015 survey by

T. Rowe Price found. Sixty-seven percent of young people follow a budget, compared to 55% of boomers.

If you’ve gotten the message about the importance of budgeting,

congratulations. But if you’re among the 33% of young people who is

never quite sure if there’s enough money in your checking account to

cover the night’s takeout order, it’s time to get smart. Learning how to

budget will

reduce stress, help you cut wasteful spending, and make it easier to bounce back after a job loss or other money crisis.

Once you start budgeting, you’ll be able to use your money to do what

you want, instead of letting it control you. Best of all, budgeting is

easy to do, if you follow some simple steps. Here’s how to budget your

finances like a boss.

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1454050058473&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1234706411&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1234706411&c.params=&c.impression_type=26&c.placement_id=ad0.7044284279793612"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1454050058473&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1234706411&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1234706411&c.params=&c.impression_type=26&c.placement_id=ad0.7044284279793612"

border="0" alt=""></a>

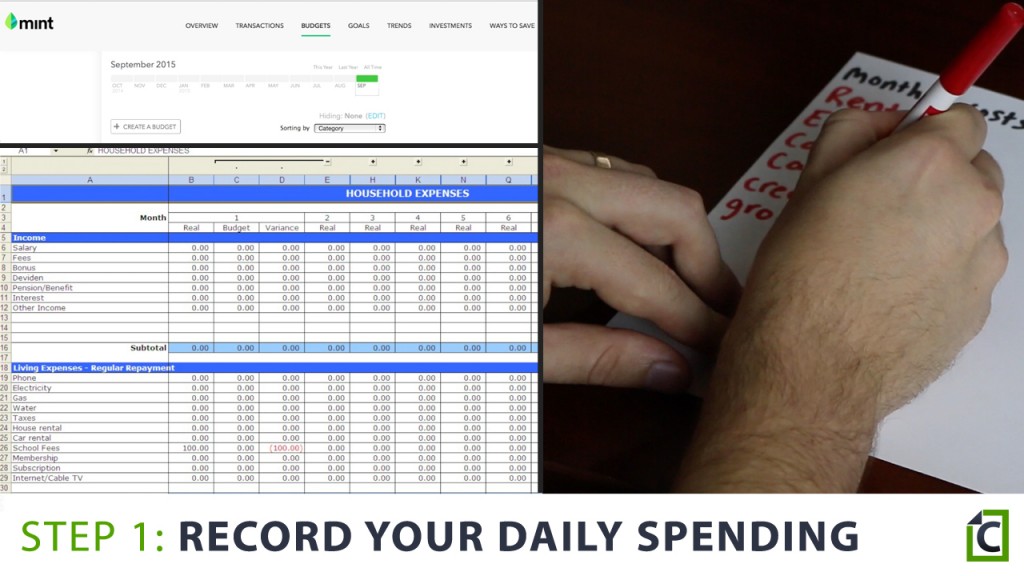

Start by tracking your daily spending in whatever way works for you.

Online tools like Mint will sync up with your checking and credit

card accounts, making it easy to track how much you spend and in which

categories. Spreadsheets work too, or you could keep it ultra low-tech

and simply write down everything you spend on a piece of paper or in a

notebook.

The tool you use doesn’t matter as long as you log every single

purchase. You need to know what exactly you’re spending money on, from

rent to daily coffee runs, before you can move on to the next step.

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1454050065074&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D729147786&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D729147786&c.params=&c.impression_type=26&c.placement_id=ad0.4147608332241063"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1454050065074&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D729147786&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D729147786&c.params=&c.impression_type=26&c.placement_id=ad0.4147608332241063"

border="0" alt=""></a>

Next, think

about what recurring expenses you have coming up in the next month, like

your car payment or student loan. Look back on your spending records

from step one to get an idea of how much money you need to get by every

month, and make sure it’s not more than what you’re bringing in.

Now is also the time to set some long-term goals. Credit card debt weighing you down?

Resolve to pay it off.

Want to buy a new car? Start setting aside money for a down payment.

Ready to take that trip of a lifetime? Figure out how much it would cost

and make saving a priority. Online tools like Mint are especially handy

here, since you can use them to set goals and track your progress.

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1454050059646&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D223589161&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D223589161&c.params=&c.impression_type=26&c.placement_id=ad0.32699788586755685"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1454050059646&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D223589161&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D223589161&c.params=&c.impression_type=26&c.placement_id=ad0.32699788586755685"

border="0" alt=""></a>

By now, you

may have realized that your regular spending doesn’t leave you with

enough cash left over for those goals you outlined in the last step.

Spending less is the easiest, quickest way to create breathing room in

your budget so you can set aside money to achieve your bigger financial

dreams.

Eliminating one meal out a week could save you hundreds of dollars

over the course of a year, for example. At $12 per person for the

average inexpensive restaurant meal,

according to Numbeo, you’ll save $624 by cooking one meal a week at home rather than succumbing to the convenience of Seamless.

<a

href="http://us-ads.openx.net/w/1.0/rc?cs=07f189b5e0&cb=1454050065114&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1567446488&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1567446488&c.params=&c.impression_type=26&c.placement_id=ad0.24984169613372786"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1454050065114&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1567446488&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1567446488&c.params=&c.impression_type=26&c.placement_id=ad0.24984169613372786"

border="0" alt=""></a>

Eating out less isn’t the only way to save. Cutting recurring

subscriptions you don’t use, watching your spending at the grocery

store, and looking for free activities are other ways to gradually trim

your budget and boost your savings. Here are

10 other unnecessary purchases

that might be eating away at your budget. Eliminate just a couple of

them and you’ll find yourself slightly richer at the end of every month.

l%2F%3Fa%3Dviewall%26nspid%3D1567446488&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1567446488&c.params=&c.impression_type=26&c.placement_id=ad0.7589350591557323"

><img

src="http://us-ads.openx.net/w/1.0/ai?auid=538013270&cs=07f189b5e0&cb=1454050059646&url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1567446488&c.width=749&c.height=109&c.tag_id=21781&c.taglink_id=33490&c.scale=0.97196263&c.url=http%3A%2F%2Fwww.cheatsheet.com%2Fmoney-career%2Fhow-to-budget-your-finances-like-a-boss-7-steps-to-managing-your-money.html%2F%3Fa%3Dviewall%26nspid%3D1567446488&c.params=&c.impression_type=26&c.placement_id=ad0.7589350591557323"

border="0" alt=""></a>

Reducing spending is great, but there’s a limit to how much you’re

willing and able to cut from your monthly budget. When you hit that

point, it’s time to look for ways to boost your income.

If you have a special skill you’d like to share with others, create an online course on a

website like Udemy. The passive income that comes from this kind of project can significantly reduce your financial stress.

This guy says he earned more than $5,000 over five months from his Udemy course.

Most of us have too much clutter in our lives. You can turn your

crowded closet or disorganized garage into a source of cash by selling

things on eBay, Craigslist, or even at a garage sale. Even stuff that

looks like trash to you can bring serious money.

“Believe it or not, there’s a huge marketplace for broken electronics for spare parts,” ebay expert Jordan Malik told

Time magazine.

Last, check up on your budget at least once every 30 days so that you

can be sure you’re on track. Dedicating just an hour or two every month

to managing your budget means that you’ll always be in control of your

finances, rather then letting them control you.

Culled from cheatsheet

No comments:

Post a Comment